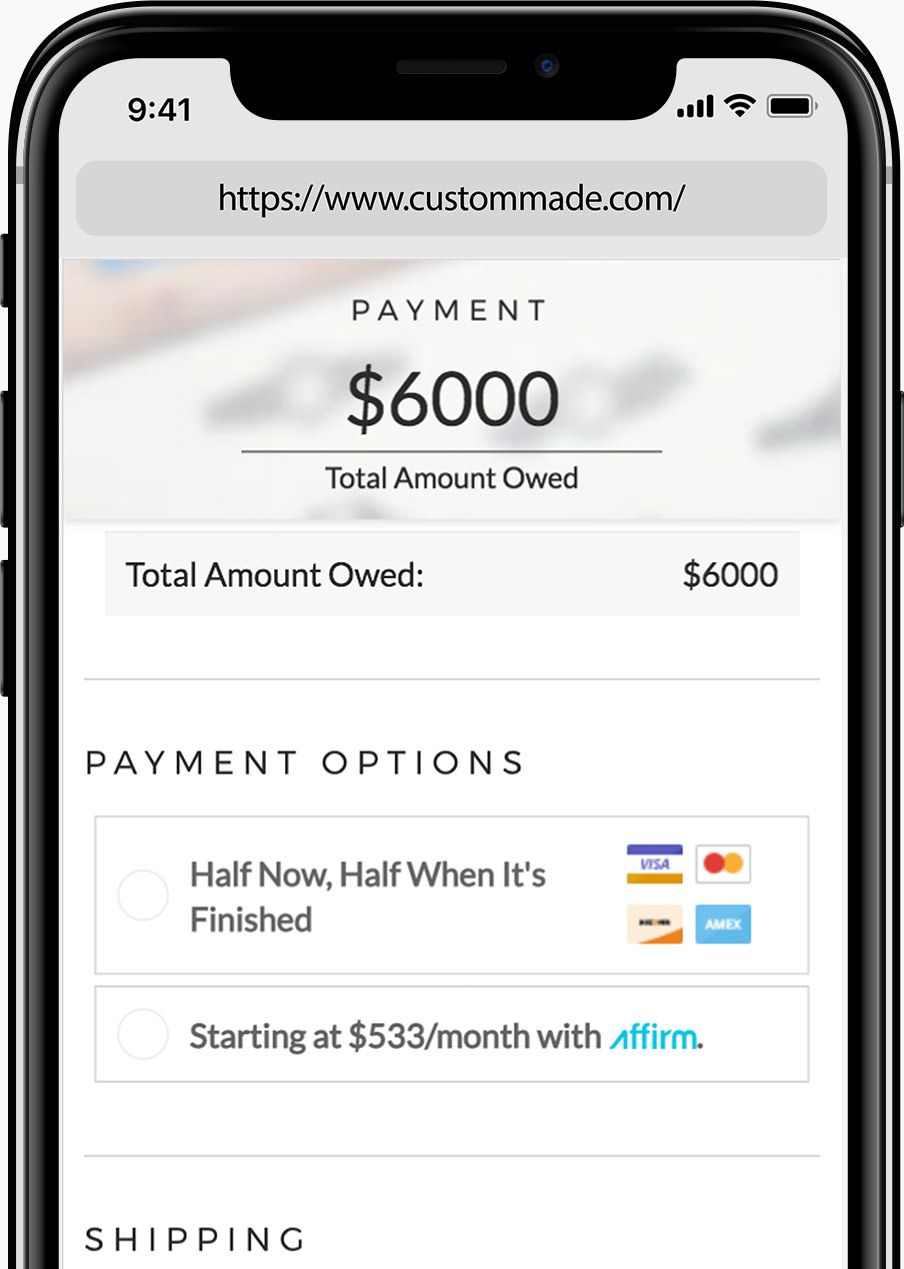

Easy Monthly Payments

Up to 24 months of financing, so you can pay over time.

10-36% APR

See exactly how much you'll pay at checkout.

Quick & Simple

Get a credit decision in real-time, and pay your bills online or via the Affirm mobile app.

No deferred interest. No hidden fees. No catch.

At CustomMade, we're focused on bringing more transparency and honesty to the jewelry industry. That's why we chose to partner with Affirm to offer a financing option for our customers who want to pay on a schedule that works for them.

Unlike many other financing providers or credit cards, Affirm is committed to clear, upfront pricing - what you see at checkout is all you'll pay. You don't have to worry about any sneaky extra costs buried in the fine print.

How To Buy Now, Pay Later With

See If You're Eligible

Financing with Affirm is available to our customers in the United States, with a few restrictions.

To qualify, you'll need:

A valid U.S. mobile phone number, and can receive SMS texts

A valid U.S. Social Security Number

A U.S. or APO/FPO/DPO home address

To be at least 18 years of age.#

Prequalifying will not affect your credit score.

Get Prequalified

Before finalizing the details of your CustomMade design, you can see what sort of loan amount you'll be eligible for by creating an account and prequalifying with Affirm

Choose Affirm at Checkout

When we're ready to begin making your piece of jewelry, choose Affirm as your payment option. Affirm will guide you through a quick application process for an instant loan decision.

Pay On Your Terms With Affirm

Choose one of the payment plans offered by Affirm, and finalize your loan. Your first payment is due 30 days from when your loan is processed.

Frequently Asked Questions

Does Affirm do a credit check, and how does it impact my credit score?

Affirm does a “soft” credit check, which verifies your identity but does not affect your credit score. Affirm's underwriting model does not use a hard credit check. There is no effect on your credit score when you apply for an Affirm loan.

How does Affirm approve borrowers for loans?

Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number. They will verify your identity with this information and make an instant loan decision. Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if you don’t have an extensive credit history.

How does the Affirm application work?

The Affirm loan-application process steps look like this:

- At checkout, choose Pay with Affirm.

- To ensure that you’re the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

- Enter the authorization code into the application form. Within a few seconds, Affirm notifies you of the loan amount you’re approved for, the interest rate, and the number of months you have to pay off your loan.

- You have the option to pay off your loan over three, six, or twelve months. Affirm states the amount of your fixed, monthly payments and the total amount of interest you’ll pay over the course of the loan.

- To accept Affirm’s financing offer, click Confirm Loan and you’re done.

After your purchase, you’ll receive monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment is due 30 days from the date that we (the merchant) processes your order.

Why can't customers outside the U.S. use Affirm?

Affirm is available only to shoppers residing in the United States. Affirm hopes to expand its services to customers outside the U.S. in the future.

What are Affirm’s fees?

The annual percentage rate (APR) on an Affirm loan ranges from 10% to 36%. Affirm discloses any required fees upfront before you make a purchase, so you know exactly what you will pay for your financing. Affirm does not charge any hidden fees, including annual fees.